MoneyKey: Reviews and Ratings

Let’s get real: not everyone has the luxury of turning to a traditional bank when things get tight. Whether it’s an unexpected car repair, rent due before payday, or just life coming at you sideways, sometimes you need fast cash, no questions asked. That’s where companies like MoneyKey come in—offering small-dollar installment loans and lines of credit online, often to folks who’ve been overlooked by the usual players.

But here’s the thing: just because you can get a loan doesn’t mean you should. And just because it’s easy doesn’t make it cheap. So let’s break down what MoneyKey offers, who it’s for, and whether the speed is worth the sticker shock.

The Basics: What Is MoneyKey?

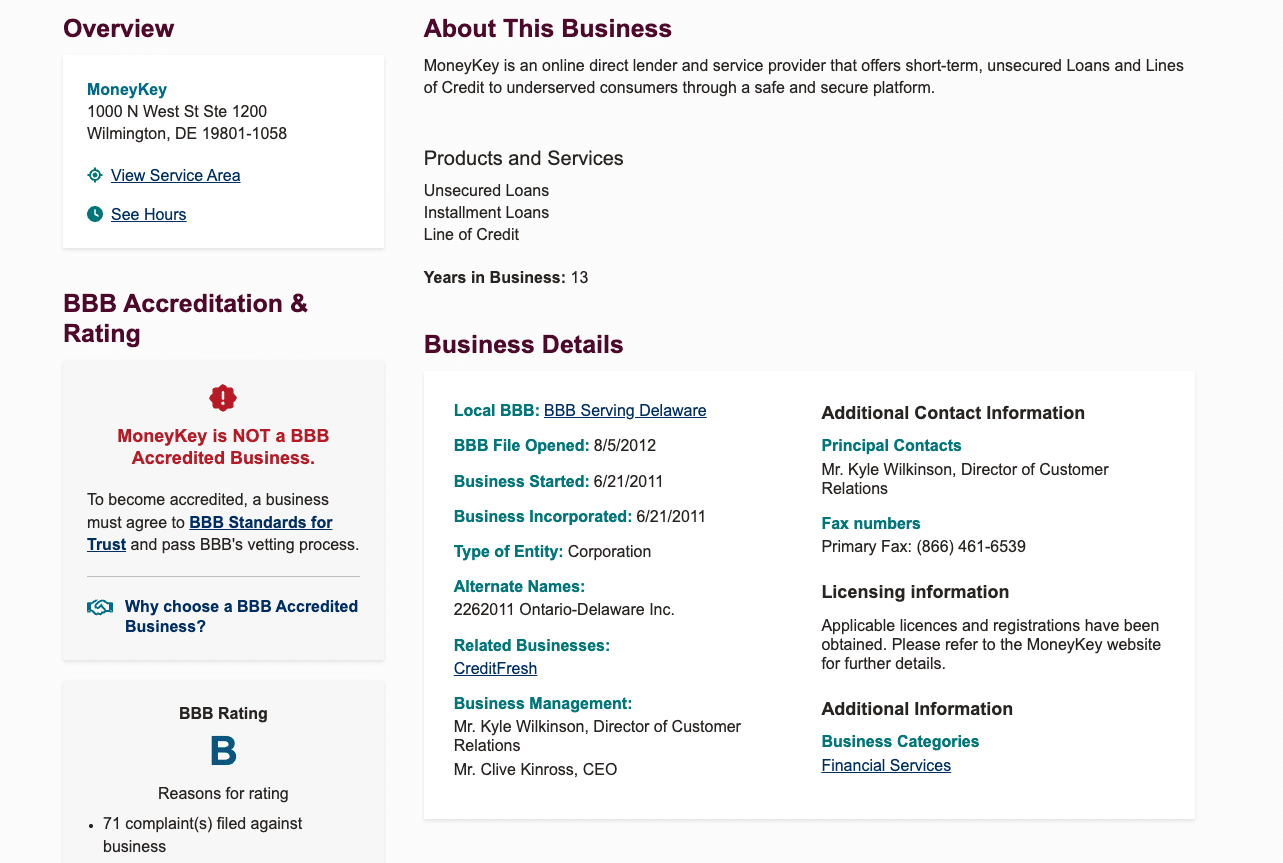

MoneyKey was founded in 2011 and is based in Wilmington, Delaware. They’re not BBB-accredited (which is always worth noting), but they do hold applicable state licenses where they operate. Think of them as a digital storefront offering quick-turnaround loans for people in a financial crunch—often those with less-than-stellar credit.

They’re a direct lender, not just a referral network, which means they’re the ones actually fronting the money (in most states). That’s rare in the short-term lending space, and it comes with its own set of pros and cons.

What They Offer

MoneyKey sticks to two main products:

- Installment Loans: $200–$2,500, repaid over 6–12 months (terms vary by state)

- Lines of Credit: $200–$3,500, revolving access if you qualify

Both options are unsecured—no collateral needed—and repayment can be set to bi-weekly, semi-monthly, or monthly. They process everything online, and if you’re approved, you could get funded as fast as the same day.

The Appeal: Why People Use MoneyKey

Let’s say it plain: convenience and speed. This isn’t your slow-moving credit union. With MoneyKey, the application is fast, the approval process is streamlined, and you don’t need perfect credit to qualify.

Here are a few standout perks:

- No origination or prepayment fees (at least not disclosed)

- Funding as fast as the same business day

- Low loan minimums—you don’t need to borrow more than you need

- Educational resources—surprisingly solid financial literacy tools for borrowers

For people in tight spots or working through financial recovery, that’s real value.

But Let’s Talk About That APR…

Now here’s where things get dicey. The APR on MoneyKey loans can reach up to 295%–306%, depending on your state and product type.

Let’s put that in perspective: if you borrow $500 for 6 months at the top end of their APR range, you could end up repaying over $900. That’s a huge burden for anyone already struggling.

Compared to traditional personal loans (which usually range from 6%–36%), this is sky-high. But it’s also in line with the payday and subprime lending industry. If your credit’s in the gutter and you don’t have better options, that’s the cost of doing business.

Who Can Apply?

You’ll need to meet a few basic criteria:

- 18 or older

- Active bank account

- Steady source of income

- Valid phone number and email

State availability is limited—MoneyKey only operates in select states like Delaware, Idaho, Mississippi, Missouri, Texas, Utah, and Wisconsin (for installment loans). So check their site to see if they’re even available in your area before you get too deep.

Customer Reports

Reviews are mixed—but not in a red-flag way. On Sitejabber, MoneyKey scores 3.8 out of 5, with over 900 reviews. Here’s the general feel:

The Good:

- “Easy process, great customer service, got funded same day.”

- “They helped when no one else would.”

The Not-So-Good:

- “Scripted reps made it hard to ask questions.”

- “Interest is high—be careful.”

The Gray Area:

- “It saved my housing situation… but the payments were no joke.”

That last one probably sums it up best. MoneyKey can be a lifeline—but there’s a cost, and it adds up fast.

How They Stack Up

Against competitors like CreditFresh, AF247, and MaxLend, MoneyKey holds its own. In fact, they rank #1 among payday loan sites on Sitejabber in terms of customer reviews.

However, in terms of web traffic and brand recognition, they’re still smaller. That’s not necessarily a bad thing—it just means fewer people know they exist.

Customer Support: Actually Not Bad

MoneyKey’s customer service team gets a lot of shoutouts in reviews, which is rare in this space. Their support hours are:

- Mon–Fri: 8am–9pm ET

- Sat–Sun: 10am–6pm ET

You can reach them at (866) 255-1668, or through their online contact form. And unlike a lot of lenders, you might actually talk to someone who sounds like they care.

Pros and Cons

Let’s break down the strong points and the not-so-strong points of MoneyKey:

✅ Pros

- Fast funding, often same day

- No prepayment, origination, or hidden fees (based on disclosures)

- Available to subprime borrowers

- Low minimum loan amounts

- Decent customer service

⚠️ Cons

- Extremely high APRs

- Limited availability by state

- Low max loan amounts

- Repayment terms aren’t very flexible

- Not BBB accredited; “B” rating with 60+ complaints.

Final Verdict: Is MoneyKey Worth It?

MoneyKey isn’t trying to be your long-term financial partner. They’re not promising wealth or transformation. What they offer is simple: fast, accessible loans when most doors are closed. If you’re backed into a corner and need help now, not next week, it’s a tool worth considering.

But this is emergency money, not everyday money. The interest can crush you if you’re not careful. So if you go down this road, do it with your eyes wide open. Borrow only what you need, pay it back as fast as you can, and don’t treat it like a payday—it’s a short-term solution, not a strategy.

If you’re someone navigating bad credit and looking to build a bridge toward something better, MoneyKey could offer a step forward—just make sure it’s not a step into deeper trouble.

Make sure to compare offers from multiple lenders, check out local credit unions, and even speak with a nonprofit financial counselor. The more you know, the stronger your next move will be.

MoneyKey FAQ

1. What is MoneyKey, and how does it work?

MoneyKey is an online lender offering installment loans and lines of credit through its platform and via CC Flow, a division of Capital Community Bank. The company targets consumers dealing with unexpected expenses who need fast access to cash. Loans can be approved the same business day, and funds are deposited into your bank account shortly after.

2. What loan products does MoneyKey offer?

MoneyKey provides:

- Installment loans: $200–$2,500, repaid over 6–12 months

- Lines of credit: $200–$3,500, flexible draws and monthly payments

These are available in select states, including Delaware, Idaho, Mississippi, Missouri, Texas, Utah, and Wisconsin for installment loans, and a broader list for lines of credit serviced by CC Flow.

3. Is MoneyKey legit and safe?

Yes. MoneyKey operates with the appropriate state licenses and partners with Capital Community Bank, a Utah chartered bank located in Provo and a member of the FDIC, for its CC Flow line of credit. The secure online platform encrypts your data, and the application process is fast and transparent.

4. What’s the difference between MoneyKey and payday lenders?

Unlike payday loans, MoneyKey’s installment loans and lines of credit offer structured repayment schedules and higher loan amounts. You don’t have to repay everything by your next paycheck. Instead, you get flexible terms with no hidden fees, and the option to pay semi-monthly or monthly, depending on your loan agreement.

5. Who can qualify for a loan with MoneyKey?

To apply for a MoneyKey loan, you must:

- Be at least 18 years old

- Have an active bank account

- Show a steady source of income

- Provide a valid phone number and email

They work with a variety of credit backgrounds, so even borrowers with bad credit may qualify.

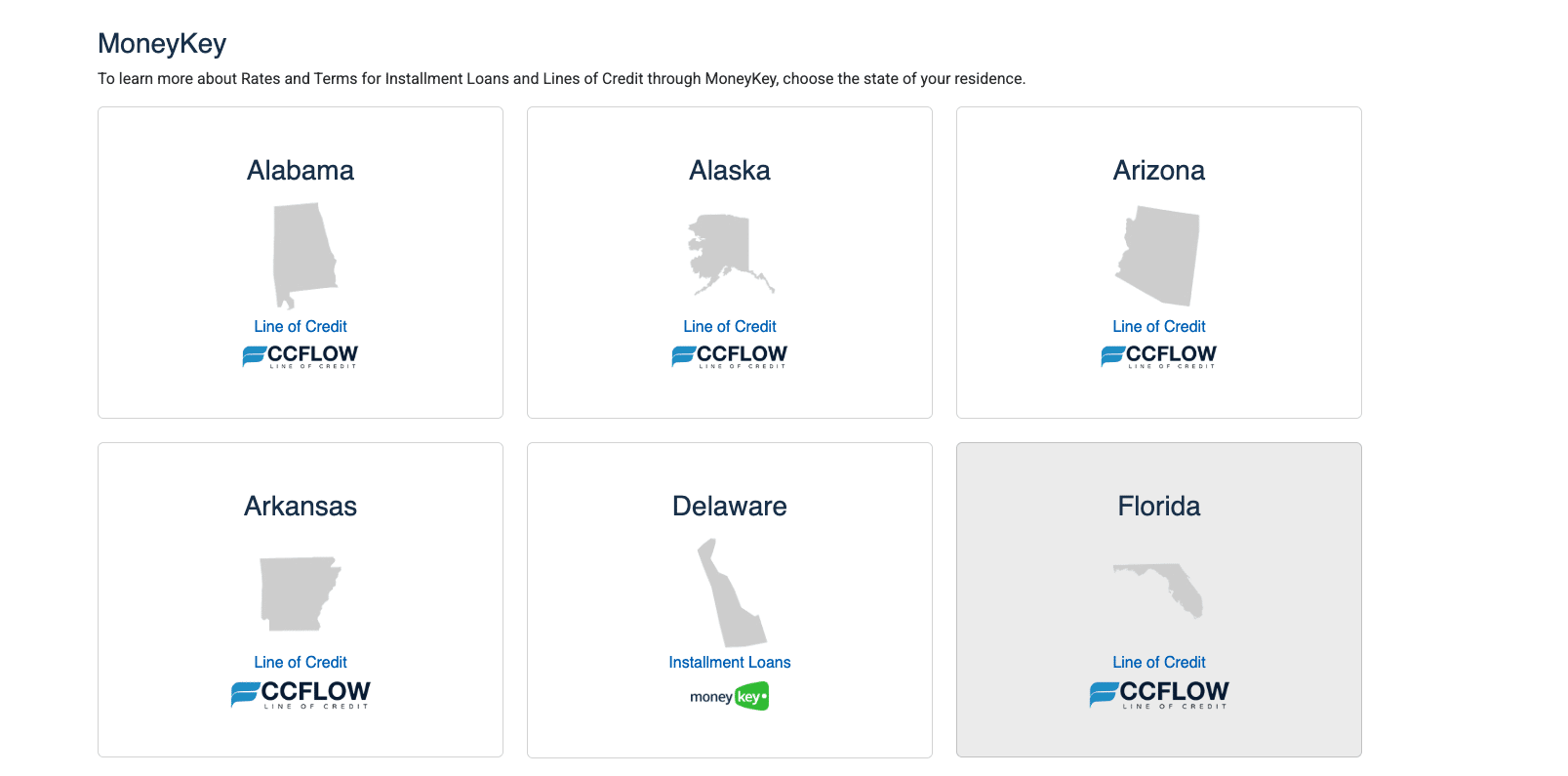

6. What states are eligible for MoneyKey loans?

Product availability varies:

- Installment loans: Delaware, Idaho, Mississippi, Missouri, Texas, Utah, Wisconsin

- Lines of credit (via CC Flow): Alabama, Alaska, Arizona, Arkansas, Florida, Hawaii, Indiana, Kentucky, Louisiana, Michigan, Montana, Ohio, Oklahoma

Always check the MoneyKey website to confirm your state’s eligibility.

7. What do customers say about MoneyKey?

Most reviews are positive, noting the five star service, quick funding, and ease of the online loan process. Users mention the helpful customer service team and how MoneyKey helped cover rent, car repairs, or bills. Some complaints focus on communication style during calls, but overall sentiment remains strong for a credit services provider in this space.