Giggle Finance: Reviews and Ratings

Let’s be real: if you’re freelancing, running a side hustle, or grinding through gig work, banks don’t exactly roll out the red carpet. It can be pretty tough to get help from any financial institution with this type of work. Try asking your local credit union for a small business loan with inconsistent 1099 income and no collateral. You’ll be lucky if they even return your email.

That’s where platforms like Giggle Finance step in, offering fast, credit-free cash advances to people who don’t fit the traditional mold. But is it a lifeline or a landmine?

Let’s break it down.

What Is Giggle Finance?

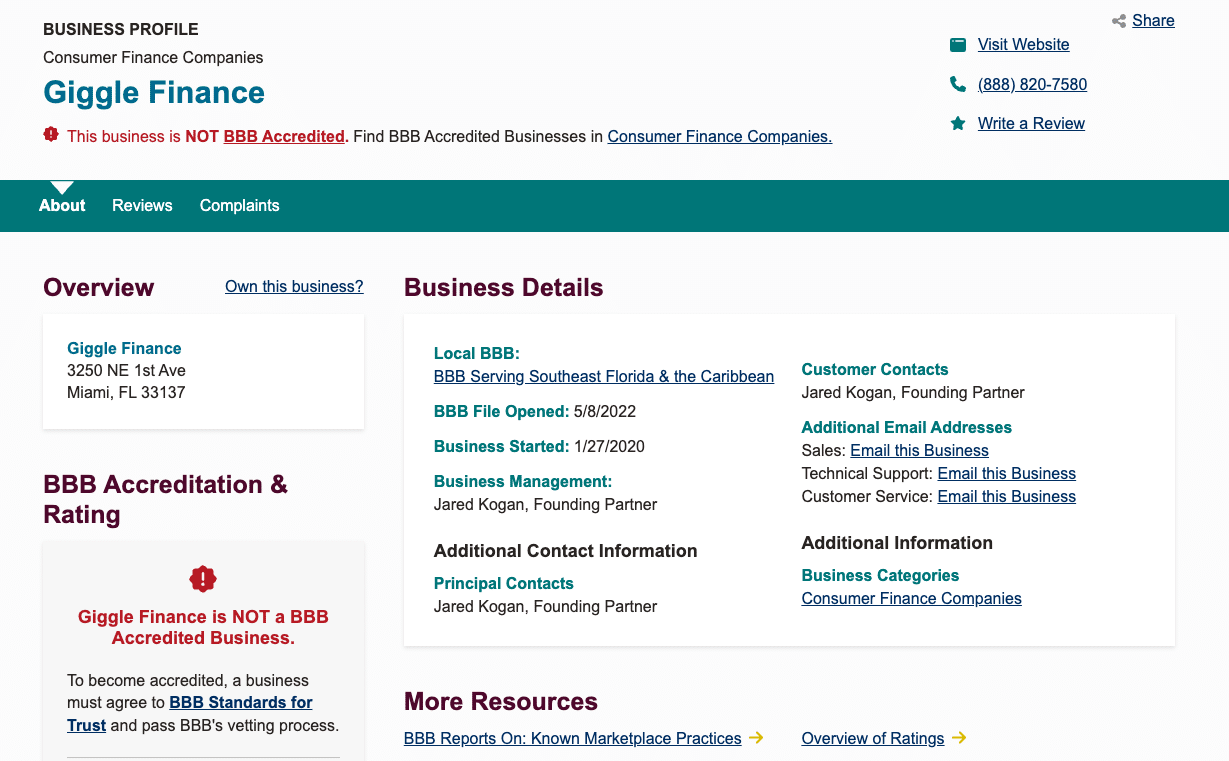

Giggle Finance launched in 2020 out of Miami, Florida. They’re not a bank, and they’re not even a lender. Technically, they’re a provider of merchant cash advances (MCAs), a structure that’s similar to a loan, but legally distinct. That distinction matters more than most people realize (more on that later).

Their pitch is simple: if you’re self-employed and bringing in at least $1,500/month, you can qualify for a cash advance—no credit check, no personal guarantee, and funding as fast as the same day.

How It Works

Here’s the rundown of how Giggle operates:

- You apply online through Giggle’s platform (don’t worry they keep it simple—no paperwork marathon).

- If approved, you get between $200 and $10,000 (repeat customers can go up to $20,000. Not a bad way to get people coming back!

- Repayment happens automatically each week, taken as a small percentage of your business revenue.

- You get the funds up front, and Giggle collects on the back end over time.

Instead of interest, they use a factor rate, usually between 1.15 and 1.52. That means if you borrow $5,000 at a 1.4 factor, you’ll owe $7,000 total.

It’s not cheap—but then again, MCAs never are.

“It was quick, and I received the money the same day.”

— Verified Giggle customer, per GiggleFinance.com

Who It’s For

- Have at least 3 months of business activity

- Earn $1,500 or more per month

- Don’t want to (or can’t) offer a personal guarantee

- Need money fast and can handle flexible repayment tied to earnings

If you’ve got bad credit, you’re in luck—Giggle doesn’t check credit scores at all. That also means this won’t help you build credit, but for some, it’s a fair trade.

Important note: Giggle isn’t available in California, New York, or Oregon. In any other state, you’re good to go.

The Good Things

✅ No credit check – If your score’s not the best, you’re still in the game.

✅ Fast funding – We’re talking same-day money in many cases.

✅ No personal guarantee – Giggle doesn’t come for your personal assets.

✅ Prepayment discounts – If you pay it off early, you might save a bit on fees.

✅ Tailored for the self-employed – Unlike many other MCA outfits, Giggle actually builds its process around the realities of gig work.

The Red Flags

❌ It’s expensive – Let’s not sugarcoat it. A 1.4 factor rate on $5K means you’re repaying $7K. That’s steep.

❌ Repayment is tied to revenue – Sounds good, but it can also be unpredictable. Slow month? You still owe.

❌ Processing/origination fees – Some users report surprise deductions from the funding amount. That’s money you don’t see unless you read the fine print.

❌ UCC lien risk – Default on your repayment? You could end up with a lien filed against your business assets.

“The only negative I experienced was the processing fee being deducted from my loan.”

— Customer review via GiggleFinance.com

How Giggle Compares

Giggle competes in the MCA space with companies like Fora Financial, Fundbox, Bluevine, and OnDeck. What sets it apart is its focus on freelancers and credit-free approvals. Most MCA providers still want to peek at your credit history. Giggle doesn’t care.

It’s worth noting, though, that MCAs as a whole are controversial. They fall into a regulatory gray area, and costs are often higher than traditional financing. That’s not unique to Giggle—it’s just part of the business model.

Real-World Example

Let’s say you’re a rideshare driver with steady income, and you take out a $5,000 advance at a 1.4 factor rate. You now owe $7,000. Repayment is automated weekly as a slice of your earnings. If you have a big month, you’ll pay more quickly. Slow month? Smaller chunks. So it could be good motivation and framing to get your advance from Giggle, pay off whatever pressing debt you had, then hustle your ass off to pay off your Giggle early, and save on fees.

But no matter what, Giggle gets their $7K. You’re just controlling the pace.

Final Verdict: Use On High Alert

Giggle Finance isn’t a scam. They’re upfront, responsive, and their product works as advertised. For gig workers and freelancers who need emergency capital without a credit check, it could be a legitimate solution.

But it’s also expensive, and the structure comes with risks. This isn’t free money, and it’s definitely not a long-term financial strategy.

Use Giggle if:

- You’re in a jam and need fast cash

- You’re confident in your ability to repay despite fluctuating income

- You’ve been denied by traditional lenders

Skip it if:

- You qualify for a personal loan, business credit card, or line of credit with better terms

- You don’t fully understand, or you’re simply not a fan of the MCA structure

- You’re relying on this money to “save” your business long-term

As always, read the fine print and ask questions. Because when it comes to borrowing, especially in the gig economy, speed should never replace clarity.

FAQs About Giggle Finance

- What exactly is Giggle Finance, and who’s it for?

Giggle Finance offers revenue-based funding built specifically for gig workers, self-employed side hustlers, and small business owners. If you’ve got a business or side hustle bringing in consistent income — even without perfect credit — Giggle’s instant approval process can give you access to working capital without the usual headache. - How fast can I get funding through Giggle?

If approved, you can receive same-day business funding. The entire process takes just minutes, from streamlined application to funds deposited into your business bank account. No lengthy forms, no costly delays, just instant cash when your hustle meets a speed bump. - Does Giggle Finance report to business credit bureaus?

Yes. On-time payment builds business credit. Giggle reports your history to help boost your business’s financial reputation, which can be a game-changer for small businesses, independent contractors, or new business owners building credibility from scratch. - What are the credit requirements?

Here’s the good news — there are none. Giggle doesn’t check your credit score. Instead, approval is based on your connected account’s activity. They review factors like average daily bank balance, past month’s revenue streams, and at least four deposits to determine approval. - Are there hidden fees or fine print I should watch out for?

Giggle is upfront about pricing, but some customers have noted processing fees deducted from the advance. It’s not shady, just something to know ahead of time. There are no surprise fees after that, and you can get a prepayment discount if you pay early. - What makes Giggle different from other online funding options?

Unlike traditional lenders or payday loans, Giggle offers a giggle financing advance that’s tied to your actual revenue. No business credit needed, no personal guarantee, and no frustrating roadblocks. Just a financing partner that understands how unpredictable gig income can be — and works with it. - Where can I find reviews or hear from other customers?

Giggle has built a base of happy customers and repeat clients who’ve shared their stories online. From Tamara C calling it a “helpful company” to others praising the speed and deposit funds process, the vibe is clear: Giggle makes funding feel like less of a gamble and more of a lifeline. - How does Giggle collect repayment, and how much will I owe?

Repayment happens automatically as a fixed percentage of your weekly business revenue. It adjusts with your cash flow, so if your income dips, your payment does too. Giggle uses a fixed-rate model, not traditional interest, which means your total cost is fixed up front. If you’re bringing in steady monthly income and want to avoid negative balances, this setup offers some breathing room. - What should new or growing businesses know before applying?

If you’re a new business owner, freelancer, or part of the gig economy, know this: Giggle isn’t a bank loan — it’s a flexible funding option based on proven revenue. You’ll need a connected account, consistent income, and a business history that shows at least four recent deposits. Giggle’s system reviews your business picks quickly and gives you instant access to working capital when you need to keep your business moving forward.