Trust And Will: Reviews and Ratings

Estate planning is one of the classic “adulting” moments that just about anybody dreads to think about having to do. It’s an easy thing to keep putting off, and for good reason. It is not something that people generally want to think about, let alone plan for. And there are very unclear objectives and guidelines for the process. It’s quite easy to feel lost and confused when the time comes to plan your estate. Luckily, however, help is out there! If you are interested in a streamlined, holistic estate planning service to help you with this unpleasant process, Trust and Will may just be what the doctor ordered!

In this article, we’re gonna go deep on everything pertaining to Trust and Will, from analyzing their business model to looking at user reviews and competitor comparisons. Trust and Will is a user-friendly online experience that hopes to make the process easy for customers. By the end of this article, you will be an expert on all things pertaining to Trust and Will, and will also gain some valuable insight on the estate planning process. So sit back, relax, and get comfy as we dive in!

What is Trust and Will?

According to Trust and Wills website, they strive to be a “modern estate planning solution designed to provide peace of mind.” To put it another way, Trust and Will wants to simplify the daunting estate planning process with a streamlined, modern website approach. Their website is streamlined, simple to understand, and user intuitive. This is very welcome in the murky territory of estate planning.

History and Overview of Trust and Will

Trust and Will was founded in 2017, and has helped over a million americans with their services. That is quite the impact! They have recently revamped their services with AI-driven personalization and expanded partnerships with financial advisors and attorneys.

Mission

Trust and Will seeks to make an affordable, easy, and accessible solution to estate planning. Given their track record, I think it’s safe to say that they’ve succeeded!

Core Services

- State-specific and legally compliant estate planning documents such as wills, revocable living trusts, and guardianship nominations.

- They also provide health care directives, HIPAA authorizations, and powers of attorney. These options allow them to provide a wide array of services and help customers with a variety of issues

Online Platform

- Trust and Will operates entirely online, which allows users to create, revise, and download or receive mailed legal documents from the comfort of home.

- Guidance is step by step. Trust and Will breaks down complex legal concepts into simple questions, meaning you don’t need a legal background or prior estate knowledge to understand what you’re doing.

Trust & Will provides a versatile array of services to help individuals create essential estate planning documents. Here’s a comprehensive and refined breakdown of their offerings:

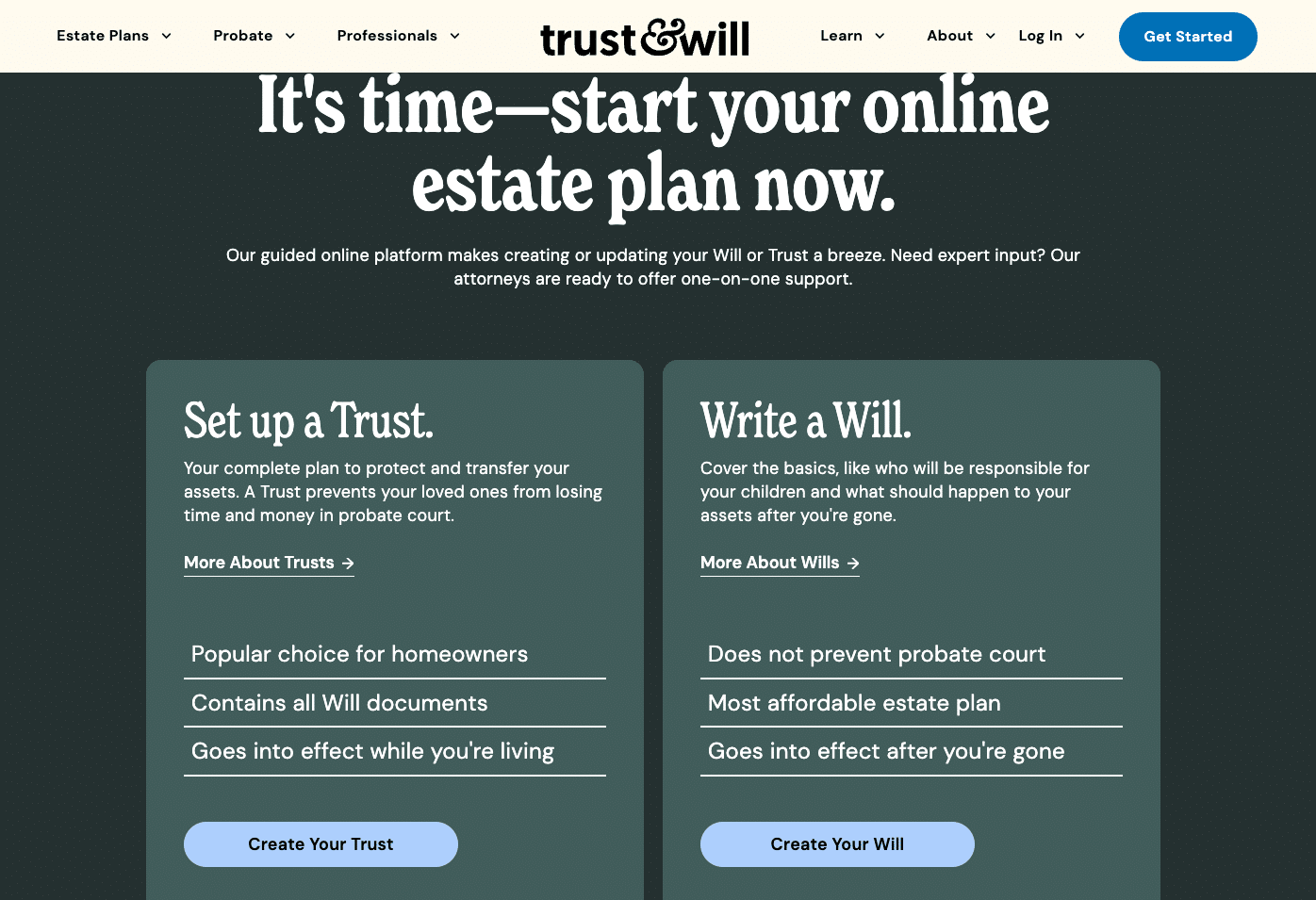

- Will-Based Estate Plan: This is your last will and testament. All this means is you document how you want your assets divided out after your death. It also let’s you decide who will be the legal guardians for your children. If you have a simple, straightforward estate, this is likely your best option.

- Trust-Based Estate Plan: This plan is centered around using a revocable living trust, which is more nuanced than will-based estate. It helps you avoid probate court if your financial situation might be too complex for will-based estate. You have more control over asset distribution.

- Key Estate Planning Documents:

- Last Will and Testament: This is a legally binding document that states how your assets will be distributed after your death.

- Revocable Living Trust: This is a legal arrangement that allows you to maintain control of your assets during your lifetime and transfer them to whoever you decide upon. Trusts also help to avoid court.

- Health Care Directives: This will allow you to decide your medical care if you become unable to make decisions for yourself, and often includes a living will and a health care power of attorney.

- HIPAA Authorization: This is a document that grants chosen individuals your health care information.

- Financial Power of Attorney: This document allows you to choose someone to manage your finances if you become incapacitated.

- Digital Assets: These are increasingly important in this day and age. Trust and Will gives you the ability to manage all of your digital assets as well.

Pros and Cons of Trust and Will

Like any service, Trust and Will has its strengths and weaknesses. Here’s an overview of the pros and cons, gathered from user reviews and comparisons to competitors:

Pros:

- User-Friendly Platform: Trust and Will is highly regarded for its straightforward process and user-friendly interface. The platform guides you through each step with clear instructions and simple questions, simplifying estate planning.

- Affordable Cost: Trust and Will is more affordable than hiring a traditional estate planning attorney, and only charges a one time fee.

- Comprehensive Services: Trust and Will provides a range of estate planning documents, including wills, trusts, and health care directives, catering to different needs.

- Bank-Level Encryption: Trust and Will employs bank level encryption to protect user data, ensuring your information is secure.

- Detailed Instructions: The platform provides detailed instructions to help you complete your documents correctly.

- Customer Support: Trust and Will offers customer support to assist users with any questions or issues they may encounter.

- Legally Binding Documents: Trust and Will helps you create documents that are legally valid and state-specific.

- Unlimited Updates (with membership): Trust & Will allows its members to make unlimited changes and updates to their documents.

Cons:

- Not Ideal for Complex Estates: If your financial situation is too complex to fit into Trust and Wills’ core offerings, you may be better off looking elsewhere for your estate planning to avoid legal trouble.

- Additional Fees: Base plans are reasonably priced, but anything deviating from the norm can cost a pretty penny. This can include attorney support or the need for annual membership.

- Attorney Support Limitations: Attorney support is not available in all states.

- Membership Costs: If you want to make changes to your estate after the first go, you will likely have to pay an annual fee.

Trust and Will Reviews, Comments, and Ratings

User experiences are invaluable when gauging if a service as important as this is the ideal option for you. Here’s a summary of ratings and reviews from several accredited platforms:

Better Business Bureau (BBB):

- Trust and Will has an A+ rating and is accredited by the BBB.

- Users generally praise the ease of use and the thoroughness of the platform.

- Some negative reviews mention issues with customer service responsiveness.

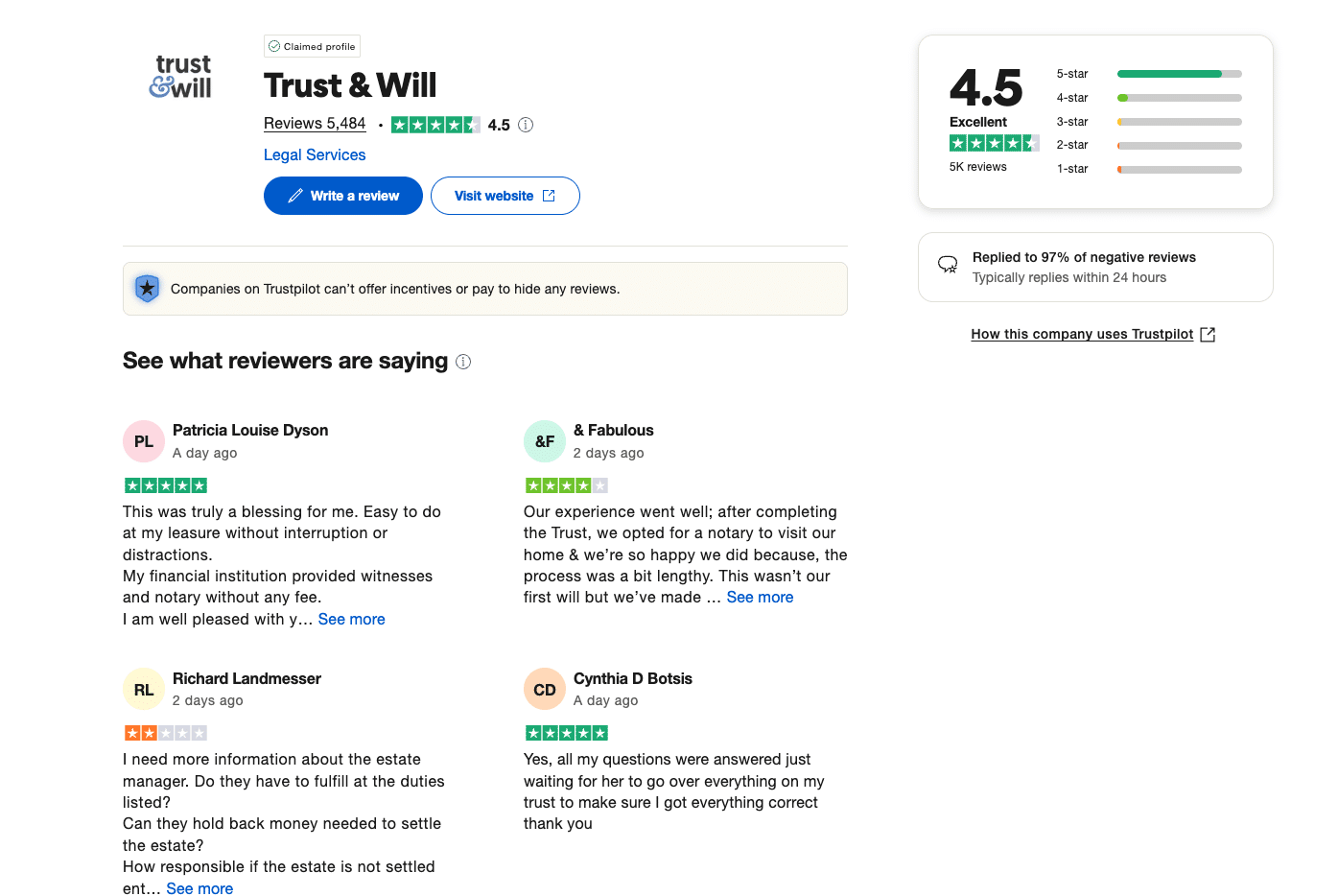

Trustpilot:

- Trust and Will has a 4.6/5 rating on Trustpilot.

- Positive comments frequently mention the user-friendly interface, efficient process, and helpful customer support.

- Users appreciate the clear instructions and the ability to intuitively create legally sound documents.

- Positive user quote: “Trust & Will made the estate planning process so easy and straightforward. The instructions were clear, and I felt confident that my documents were legally sound. Highly recommend for anyone looking to get their affairs in order without the hassle.”

- Negative reviews sometimes cite issues with the membership fee structure or the limitations of the online format for complex situations.

- Negative user quote: “The process started off well, but I ran into issues with customer support when I had questions about my documents. It took several days to get a response, and I didn’t feel like my concerns were fully addressed. Disappointed with the follow-through.”

Google Reviews:

- Trust and Will generally receives positive reviews on Google, with a 4.6/5 rating.

- Users highlight the convenience, affordability, and efficiency of the online platform.

- Many appreciate the ability to complete their estate planning documents at their own pace.

- Some users have expressed concerns about the lack of personalized legal advice.

Individual experiences can vary. Also, keep in mind that many negative reviews are either trolls or people who were blindsided by certain aspects of the process due to lack of research. Nonetheless, reading a range of reviews can help you get a balanced perspective on Trust and Will’s services.

Comparison to Competitors

There are plenty of options in the online estate planning service field, and understanding how they compare to each other will aid in picking the most appealing one for your needs and desires. Here’s a handy comparison of Trust and Will with some of its competitors:

| Feature | Trust and Will | Rocket Lawyer | LegalZoom | FreeWill |

| Services Offered | Wills, trusts, health care directives, digital assets | Wills, trusts, legal documents, attorney access | Wills, trusts, legal documents, attorney assistance | Wills, basic estate planning documents |

| Pricing | One-time fee for documents; annual membership for updates; extra fee for attorney support | Membership-based; includes attorney consultations | One-time fee for documents; additional fees for attorney assistance | Free for basic documents; no ongoing fees |

| Attorney Support | Available in some states for an additional fee | Included in membership | Available for an additional fee | Limited attorney access through FreeWill Fellows network |

| User Experience | User-friendly, straightforward process | Focus on legal access, may be more complex | Well-established brand, interface can vary | Very simple, basic interface |

| Best For | Individuals and couples with straightforward estate planning needs | Individuals and small businesses seeking ongoing legal support | Individuals seeking a balance of online convenience and attorney access | Individuals with very simple estates seeking a free, basic solution |

| State Specific | Yes | Yes | Yes | Varies |

| Updates | Unlimited with annual membership | Included in membership | Typically extra fee | Free |

| Probate Tools | Yes | Varies | Yes | No |

| Trust Based Plan | Yes | Yes | Yes | No |

| Will Based Plan | Yes | Yes | Yes | Yes |

Each service has points of emphasis and strengths. The best option for you will depend on your individual circumstances, the complexity of your estate, and your budget. Consider factors such as the level of attorney support you require, the complexity of your estate, and whether you prefer a one-time fee or an ongoing membership model. Make sure to research all options!

How to Apply with Trust and Will

Are you feeling good about using Trust and Wills services at this point? We’re glad! You’re probably wondering how to apply if that’s the case. Don’t worry, we got you covered. Trust and Will’s application process is remarkably straightforward. Here’s a step-by-step guide:

- Visit the Website: Go to the Trust and Will website.

- Choose a Plan: Select the plan that best suits your needs (Will-Based or Trust-Based).

- Create an Account: You’ll need to create an account to get started.

- Complete the Questionnaire: The platform will guide you through a series of simple questions about your assets, family, and wishes.

- Review Your Documents: Once you’ve completed the questionnaire, Trust and Will will generate your estate planning documents. Review them carefully to ensure they accurately reflect your intentions.

- Finalize and Execute: Follow the instructions provided to properly sign and execute your documents according to your state’s laws. This may involve notarization and witnesses.

- Store Your Documents: Store your completed documents in a safe and accessible place.

- Consider Attorney Support: If you have questions or need legal guidance, you can add attorney support (where available) for an additional fee.

- Annual Membership: Consider whether the annual membership for unlimited updates is right for you.

Is Trust and Will Right For You?

Let’s take everything we have learned about Trust and Will and compile it all into a simple question: Are they right for you? Let’s break this question down so you can be certain that Trust and Will is the best option for your needs.

Trust and Will can be a good option for individuals and couples who:

- Prefer an online, user-friendly approach to estate planning.

- Have relatively straightforward estate planning needs.

- Want to create essential documents like wills, trusts, and health care directives at a reasonable cost?

- Value the convenience of completing the process from home.

- You are looking for a platform that offers clear instructions and customer support.

However, Trust and Will may not be suitable for those with:

- Highly complex financial situations.

- Unique circumstances that require personalized legal advice.

- A strong preference for working directly with an attorney.

And it’s as simple as that! Remember, this is a simple resource, and there are plenty more resources out there to research in order to make the best decision for your needs.

Final Thoughts

Estate planning is an essential aspect of legacy planning with your family in mind. While it is a daunting and unclear process, services such as Trust and Will aim to simplify the process and make it accessible.

Trust and Will has a lot to offer, including a user-friendly platform, a range of essential documents, and affordability compared to traditional estate planning attorneys. The platform’s emphasis on an easy process and clear instructions can help ease the anxiety associated with estate planning. An extra level of customer ease of mind can be found in their use of bank-level encryption and automatically secured systems.

With all this being said, online services may not be suitable for everyone. If you have a complex financial situation or require personalized legal advice, consulting with an estate planning attorney is most likely the best course of action.

Before making any decisions, conduct thorough research, compare different options, and consider your specific needs and circumstances. By taking the time to plan your estate, you can gain peace of mind knowing that you’ve taken steps to protect your loved ones and secure your legacy. We hope this article helps you make this important decision!

Frequently Asked Questions (FAQ) About Trust and Will

Here are some common questions people have about Trust and Will:

Q: Are Trust and Will documents legally valid?

A: Yes, Trust and Will creates state-specific documents that are designed to be legally valid when properly signed and executed according to your state’s laws.

Q: Does Trust and Will offer attorney support?

A: Yes, Trust and Will offers access to attorney support in certain states for an additional fee. This can provide guidance and answer your legal questions.

Q: How much does Trust and Will cost?

A: Trust and Will charges a one-time fee for its estate planning documents. The cost varies depending on the plan you choose (Will-Based or Trust-Based). They also offer an annual membership for unlimited updates and may have additional fees for services like attorney support. For specific pricing details, it’s best to visit their website.

Q: Can I update my Trust and Will documents?

A: Yes, you can update your Trust and Will documents. Trust & Will members can make unlimited changes to their documents.

Q: Is Trust and Will secure?

A: Yes, Trust and Will uses bank-level encryption to protect your personal information and ensure the security of your data.