PDS Debt: Reviews and Ratings

Debt is a common component of life in this day and age. Prices are higher than ever, forcing millions of Americans to borrow money that they aren’t quite able to pay back. While this can feel discouraging and isolating to anyone stuck in this position, two things need to be kept in mind. One, you’re not alone. Many people are in a similar situation, and there’s no shame in it. You’re in this struggle together! And two, there are options for you to climb your way back to financial freedom. Bankruptcy does not have to be in your future. So, stay positive and form a plan of attack. A good plan would be to employ a debt consolidation service. Today, we’re gonna put a spotlight on the company PDS Debt, to help you not only understand the debt consolidation scene, but also help you make an informed decision as to whether PDS Debt will be a good option for you to improve your financial standing.

Let’s emphasize one key point, however. Even if you read this article and decide that PDS Debt is the service for you, the research should not end there. Making rash financial decisions is a recipe for staying in debt. If your situation doesn’t align with PDS Debt for any reason, or there is a better option out there that you neglected to find, you are doing yourself a disservice. So do thorough research on what’s out there. Think of this article as a jumping-off point from which you can build your knowledge of finances. After all, knowledge is power.

PDS Debt sells themselves as a highly adaptable debt relief service that is committed to understanding your unique situation fully and leveraging this personalized approach to save you the most money on your debt. Their website states that they are focused on “custom debt relief management.” They offer a free consultation to gain a full picture of your finances that they can use to come up with a custom game plan.

We will go in-depth on all things pertaining to PDS Debt, including their core services, principles, customer reviews, and comparison with competitors. By the end of this article, you will be an expert on all things related to PDS Debt, to help you in your quest for financial freedom. Let’s jump right in!

PDS Debt: History and Overview

PDS Debt has been operating for over 15 years, establishing themselves as a leading presence in the debt relief industry. They have assisted a significant number of clients, with some metrics stating that they work on thousands of cases daily. PDS Debt has established a well regarded reputation.

Their focus area is on unsecured debts which generally includes credit card debt, medical bills, personal loans, and collections.

Here’s an overview of their core services, broken down in an easy-to-understand manner:

- Debt Consolidation: PDS Debt will combine all your multiple debts into a single, manageable monthly payment, often at a lower interest rate. This will take the stress of juggling multiple debtors out of the equation for you, and can potentially save you money over a period of time. This consolidated approach is very helpful If you’re overwhelmed.

- Debt Negotiation: PDS Debt negotiates with your creditors to reduce the total amount you owe. This involves lowering interest rates, waiving fees, or even reducing the principal balance. They have an experienced team of negotiators who are committed to trying everything possible to get the best possible outcome for your financial situation.

- Credit Counseling and Education: PDS Debt also provides financial education through hands-on guidance, resources for managing your finances, effective budgeting principles, and ways to improve your credit score. This service can aid you in side-stepping financial holes in the future.

PDS Debt: Pros and Cons

Just like any service out there, PDS Debt has areas that are very strong and areas where it might lag a bit. Let’s analyze these pros and cons here in a methodical fashion:

Pros:

- Personalized Approach: PDS Debt goes to great lengths to advertise themselves as a personalized experience, and their process backs up the way they present themselves. With a free consultation and fluid business model, they are well positioned to devise the perfect plan for you.

- Experienced Professionals: There are true professionals on the PDS Debt team, who are well versed at negotiating with negotiating and debt consolidation strategies.

- Free Consultation: At no charge, you can have a well tailored game plan created to instill confidence in their service for you. It just takes consultation with a professional.

- Potential Savings: This is what you are likely looking for. After your game plan is devised and the negotiations are underway, you’ll be able to save a lot of money on your debt with PDS Debt’s service.

- Simplified Finances: The way your savings will work is that you will have all of your debt consolidated into one payment per month that goes to PDS Debt, which will also remove any confusion and chaos from having multiple debtors to pay on different schedules.

- Customer Service: This is viewed as a highlight for many customers, who find the representatives very helpful and willing to walk debtors through the entire process and answer any questions with grace and positivity.

Cons:

- Not a Quick Fix: Debt relief generally takes 24- 48 months. It requires patience and sticktoitiveness in order to get through. This can potentially be a turnoff to some customers.

- Credit Score Impact: An unfortunate aspect of debt relief solutions is the impact on credit score. Because you will not be paying your creditors, you are in debt to and will instead be paying PDS Debt, your credit will take a hit over the course of the program.

- Fees: There are fees involved in the service. Make sure you have a full understanding of the fees before enrolling, as they are dependent on the type and amount of debt you have.

- Results Not Guaranteed: Unfortunately, Debt Relief is not successful 100% of the time. The representatives will negotiate on your behalf to the best of their efforts, but sometimes the debtors will be unwilling to play ball, or they have specific policies that can’t be worked around.

PDS Debt: Comments, Reviews, and Ratings

Existing user testimonials are highly valuable when analyzing a service. After all, what better way to predict what your experience will be than reading prior customer experiences? Here is a breakdown of customer reviews across different reputable review platforms:

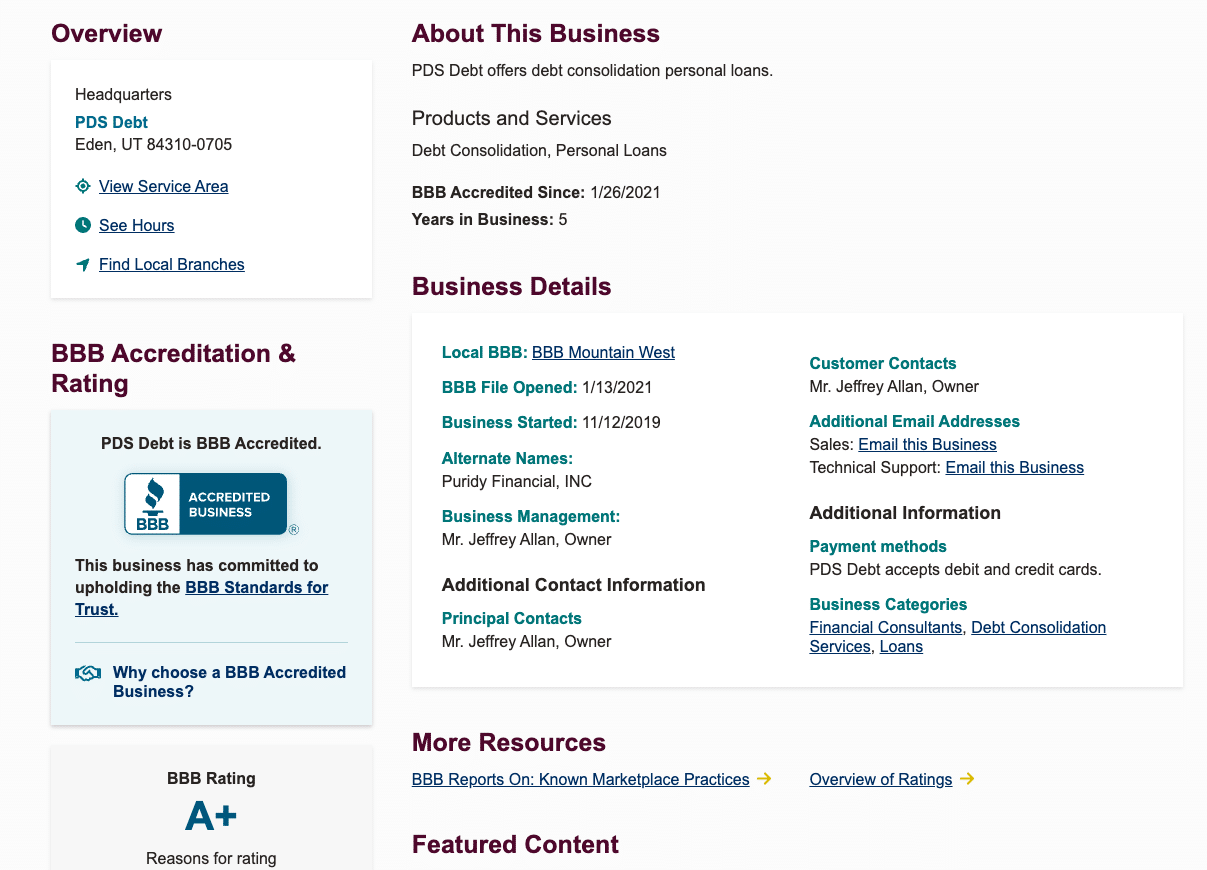

- Better Business Bureau (BBB): PDS Debt has a rating of A+ with the Better Business Bureau. This indicates a strong commitment to resolving customer complaints and maintaining ethical business practices.

- Trustpilot: PDS Debt has received “Excellent” ratings on Trustpilot, with a high average score based on numerous customer reviews. Many reviewers praise the company’s customer service, the clarity of their explanations, and the effectiveness of their programs.

- Google Reviews: PDS Debt also has generally positive reviews on Google. Customers often mention the helpfulness and professionalism of the staff, as well as the positive results they’ve achieved in reducing their debt.

While many reviews are positive, there are a fair number of negative experiences. The most common ones are as follows:

- The impact on their credit score.

- The length of the program.

- Unexpected fees or lack of clarity around program details.

Many of the negative comment subjects can be addressed with a thorough understanding of the debt settlement process prior to signing off on any deal. Here are some real customer quotes, both positive and negative, compiled from various online sources:

- Positive: “PDS Debt is doing a great job, they are helping me pay down a loan and a maxed out credit card that I can no longer afford…My minimum payments are going down, and they will get paid off quicker.”

- Positive: “The whole process through these guys was less than an hour, and they were all very kind and quite thoughtful throughout the entire time!”

- Negative: “I enrolled in [a program] approximately 4 years ago. Now suddenly I can’t reach them and… the company says I owe them…”

- Negative: “They took all my money and won’t give it back… Fraudulent activity.”

Individual experiences will always vary. It’s worth noting, also, that many people will leave negative reviews out of emotion when they were blindsided by a part of the process, so make sure you know what you’re signing up for!

Comparison to Competitors

The debt relief industry is filled with plenty of options, each with its own specialties and points of emphasis. It’s important to compare your options to find the best fit for your needs. Here’s a general comparison of PDS Debt to some of its direct competitors:

| Metric | PDS Debt | SimplicityCollect | QUALCO Debt Collection | Cogent Debt Collection |

| Services Offered | Customized debt relief for credit card, medical, personal loans, and collections debt. Uses proprietary technology to tailor solutions to individual needs. | Cloud-based collections management for agencies, law firms, HOAs, and judgment recovery. Includes case management, financial tracking, and real-time reporting. | Technology solutions for debt management, including early/late collections, payment processing, compliance, and omni-channel customer contact. | On-premise debt collection and case management. Features rules engine, onboarding, document management, and calendar functionalities. |

| Fees | No upfront fees; performance-based-fees only charged after debt is being paid down. Transparent cost structure detailed upon approval. | Subscription-based, starting at $249/month. Some users report recent fee increases for small business clients. | Pricing not publicly listed; fees likely based on enterprise contracts and solution scope. | Pricing details not publicly listed; typically enterprise-level licensing. |

| Experience and Reputation | In business since 2019. BBB accredited since 2021 with an A+ rating. Known for transparency and client support. | Well-regarded for ease of use and value for small to mid-size agencies. Positive user reviews for features and support. | Established provider in the debt management industry, serving large agencies and financial institutions. Focus on regulatory compliance and innovation. | Positive user reviews for robust feature set and productivity enhancements. Used by agencies seeking customizable workflows. |

| Accreditation and Licensing | BBB accredited business. Operates under Puridy Financial, INC. | No specific accreditations listed; software provider for agencies and legal professionals. | Complies with industry regulations and provides tools for regulatory oversight and compliance. | No specific accreditations listed; enterprise software provider. |

It’s important to note that this is a simplified comparison, and the actual costs and results can vary significantly depending on your individual circumstances. When comparing debt relief companies, consider the following factors:

- Services Offered: Ensure the company offers the specific services you need (e.g., debt consolidation, debt negotiation).

- Fees: Carefully compare the fee structures of different companies.

- Experience and Reputation: Look for companies with a proven track record and positive customer reviews.

- Accreditation and Licensing: Verify that the company is properly accredited and licensed to operate in your state.

- Customer Service: Choose a company that provides responsive and helpful customer service.

How to Apply

If at this point you are feeling good about PDS as a solution for your financial situation, you’re likely wondering how the application process looks. Well, don’t worry, we have you covered! The following is a step-by-step guide for how to apply :

- Free Consultation: Contact PDS Debt by phone or through their website to schedule a free consultation.

- Financial Assessment: During the consultation, a PDS Debt representative will gather information about your financial situation, including your income, expenses, and debts.

- Personalized Plan Development: Based on your financial assessment, PDS Debt will develop a personalized debt relief plan that outlines the recommended strategy and estimated costs.

- Enrollment: If you decide to proceed, you’ll enroll in the program and sign a service agreement.

- Program Implementation: PDS Debt will then begin implementing your plan, which may involve negotiating with your creditors or consolidating your debts.

- Progress Monitoring and Communication: PDS Debt will keep you informed of the progress of your program and provide ongoing support throughout the process.

Is PDS Debt Right For You?

Let’s simplify everything we have reviewed so far about PDS Debt into the question: Is PDS Debt right for you? Let’s break down what kind of person would get the most out of their services.

PDS Debt may be a suitable option if you:

- Are you struggling to keep up with your unsecured debt payments?

- Feel overwhelmed by the burden of multiple debts and creditor calls.

- Are you seeking a personalized approach to debt relief that addresses your specific financial challenges?

- An understanding of the fact that the process of debt relief takes time.

- Value customer service and positive client interactions.

However, PDS Debt may not be the best fit if you:

- Are you looking for a quick fix or an immediate solution to your debt problems?

- You are unwilling to accept the potential negative impact on your credit score in the short term.

- Prefer to handle debt negotiations with creditors on your own.

- Do not have a steady income or the ability to make consistent monthly payments into a debt relief program.

- Are you concerned about the impact on your credit score

Final Thoughts

Navigating the world of debt relief can be daunting, especially when you lack knowledge of your options. Always remember that you’re not alone, and there are services that are committed to getting you back on your feet.

PDS Debt offers a personalized approach to debt relief, aiming to tailor its services to your unique circumstances. Their emphasis on customer service and their willingness to work with clients to develop customized plans can be valuable assets as you get your finances back on track.

Always remember, don’t jump the gun on debt relief services without conducting thorough research and carefully considering your options. Remember that debt relief programs often involve trade-offs, such as potential damage to your credit score.

Ultimately, the best debt relief solution for you will depend on your individual financial situation, your goals, and your comfort level with the pros and cons of your options. By educating yourself and seeking professional guidance, you can make an informed decision and take a significant step towards a brighter financial future. Good luck on finding the right solution! We hope this article helps you on your journey.

FAQ

Here are some frequently asked questions about PDS Debt:

- Q: How does PDS Debt’s debt negotiation process work?

- A: PDS Debt works with your creditors to negotiate a reduction in the total amount you owe. This can involve lowering the principal balance, reducing interest rates, or waiving fees. Their negotiators use their experience and knowledge of industry practices to advocate on your behalf.

- Q: Will PDS Debt’s program affect my credit score?

- A: Yes, debt negotiation programs typically have a negative impact on your credit score in the short term. When creditors agree to a settlement for less than the full amount owed, it is often reported to credit bureaus, which can lower your score. However, over the long term, successfully completing a debt relief program and becoming debt-free can put you on a path to rebuilding your credit.

- Q: How are PDS Debt’s fees structured?

- A: PDS Debt charges fees for its services, but the specific fee structure can vary depending on factors such as the amount of your debt, the type of debt, and the program you enroll in. It is essential to discuss the fee structure in detail with your PDS Debt representative during the initial consultation to ensure you fully understand the costs involved.

- Q: What types of debt does PDS Debt handle?

- A: PDS Debt primarily focuses on unsecured debts, including credit card debt, medical bills, personal loans, and collections. They generally do not handle secured debts like mortgages or car loans.

- Q: How long does it take to become debt-free with PDS Debt?

- A: The time it takes to become debt-free with PDS Debt varies depending on individual circumstances, such as the amount of debt, the number of creditors, and the success of negotiations. A typical debt relief program can range from 24 to 48 months, but it could be shorter or longer.