PriorityPlus Financial: Reviews and Ratings

Unexpected bills are no fun. Neither is it needing home renovation without the savings to get it done. We can all agree that living with financial stressors is a huge burden. It’s also a huge burden to navigate the financial lender landscape. With so many different options and so little available time to explore all of them, it can be yet another pain. With this article, we seek to provide a jumping off point with Priority Plus Financial, so you can potentially realize them as your choice of lender, and learn about lending along the way.

Especially for those who are in a lower credit score bracket, finding suitable loans is hard. Traditional bank lenders generally have more stringent requirements, making acceptance impossible with a lower score. This is where priority plus comes in handy. They sell themselves as a connector that has a database of lenders with which to share with prospective borrowers. This can be a godsend for people who have limited options due to poor credit.

Here is an important point, however. No matter what you discover or get accepted for as far as loans go, self-autonomous research is always paramount. Taking the time to understand your own financial needs and researching all the entities you’re learning about will save you a lot of wasted time and money. With that being said, let’s dive into the world of Priority Plus Financial!

PriorityPlus Financial Overview

This model is getting increasingly common over the years. Technology over time moves in the direction of streamlined and efficient, and this is exactly the lane that Priority Plus exists in. If you have been rejected by lenders due to poor credit history , Priority Plus Financial could potentially bring to your attention some viable options you wouldn’t have found on your own.

Here’s a breakdown of their services:

- Personal Loans: This is the core offering, and the most common reason people would use their services. Personal Loans can be used for a wide variety of needs, including credit card debt, big purchases, or debt consolidation.

- Lending Network: Priority Plus Financial is not a lender themselves, but they will direct to you attention an array of options that could fit your needs from their comprehensive database of lending companies.

- Online Application Process: Their fully modern approach allows for the accessibility and efficiency of online usage. Everything in the lending process can be accomplished from the comfort of your home or on the go.

- Matching Services: Their platform is designed to match you with the lenders most likely to offer you a loan. This will raise your chances of successfully securing a loan.

It’s important to remember that Priority Plus Financial is the intermediary, connecting you with the actual loan provider. The terms and conditions of your loan, including interest rates, fees, and repayment schedules, will be determined by the specific lender you are matched with.

Pros and Cons of PriorityPlus Financial

Every service has pros and cons. Here are Priority Plus Financials clearly outlined good and bad qualities:

Pros:

- Wider Access to Funds: If you don’t qualify for traditional bank loans due to subprime credit, Priority Plus will offer you greater chances at securing a loan by finding lenders that will accommodate you.

- Convenient Online Application: Unlike traditional in person lenders, Priority Plus Financial has a streamlined modern approach, using website as their hub for users.

- Potential for Multiple Offers: With their extensive network of lenders, you can choose the ones that give you the best rates and compare side by side.

- Time Savings: Instead of having to look at each individual lender and fill out multiple applications, with Priority Plus Financial, you only have one application on their website, and they will do the networking for you.

- Fast Funds: Since the front-end process of getting loans is so much faster, the actual acquisition of funds will be faster.

Cons:

- Interest Rates and Fees: There is a wide range of interest rates and fees compared to traditional bank loans. Their current range sits at 5.45% to 29.99%. This is on the higher side.

- Lack of Direct Relationship: Since they’re a connector, you will be dealing directly with the lenders you choose. This means various applications and requirements.

- Transparency Concerns: Understand that Priority Plus Financial makes money based on referrals to lenders. Use this information to your advantage by carrying natural skepticism.

- Variable Loan Terms: The loan terms can and will vary among the lenders. This can make it hard to predict exactly what you’re signing up for.

- Risk of Predatory Lending: Be cautious that predatory lenders are out there. If there is a shady buck to be made, companies will try. Be sure to know aht you are signing up for.

Comments, Ratings, and Reviews

To get a real sense of what people experience with Priority Plus Financial, let’s look at what users are saying on reputable review platforms:

Better Business Bureau (BBB):

- Rating: They are currently unaccredited by the BBB, but hold an excellent 4.36/5 based on customer reviews

- Positive Comment: “I had an excellent experience working with *****. He was professional, patient, and knowledgeable, helping to lower my monthly credit card payments. He explained everything clearly and made sure I understood my options without any pressure. It was refreshing to find someone that advocates for people struggling with debt, considering how predatory credit care companies tend to be. I highly recommend their services and **** to anyone looking for real debt relief.”

- Negative Comment: “The loan offer in their mailer was misleading. When I called, I was told I didn’t qualify for the advertised rate and was pushed toward debt settlement instead. Not transparent.”

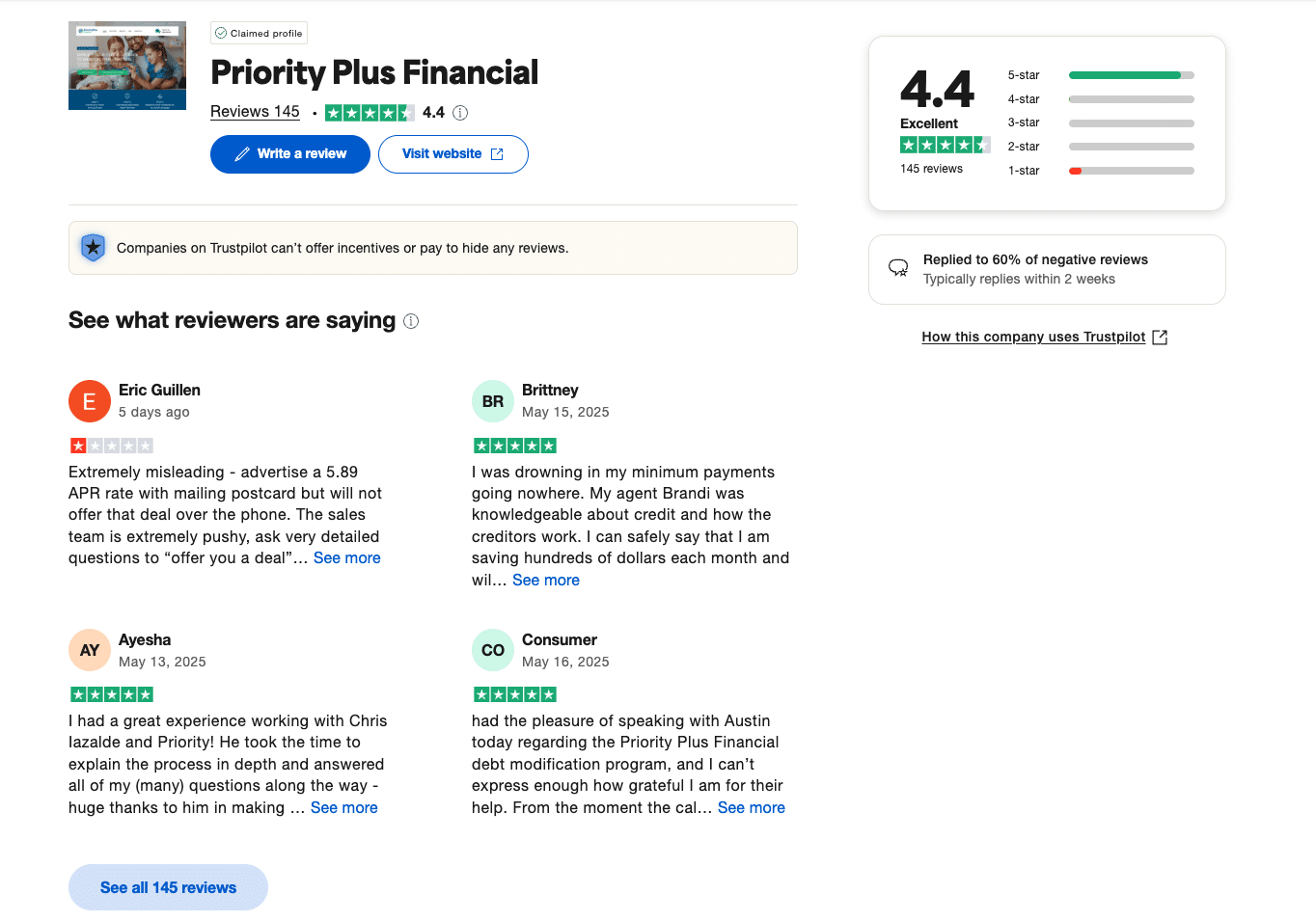

Trustpilot:

- Rating: Priority Plus has a 4.4/5 score on Trustpilot based on 119 customer reviews, which is considered an “excellent score on the site.

- Positive Comment: “The staff was friendly and efficient, and I had an overall great experience. The loan process was fast, and I received my money within a day or two.”

- Negative Comment: “I responded to a mailer but felt deceived. I was told I didn’t qualify for a loan due to not meeting the minimum, but the website listed a different amount. Communication was poor.”

Google Reviews:

- Rating: On Google Reviews, they hold a 4.2 out of 5 based on 100 reviews.

- Positive Comment: “Great company. Understands what you are going through and takes great care to make sure you are not alone in your journey to financial health and well-being.“

- Negative Comment: “The person I spoke with tried to push me to sign the agreement ASAP. The program was new to me, so I asked questions and hoped to get answers, but the person kept saying he mentioned it already and became very annoyed.”

Key Takeaways from Reviews:

- Many users appreciate the speed and convenience of the online application process and the ability to access a network of lenders.

- Some users have noted that the interest rates offered through the platform can be higher than those from traditional banks.

- Experiences with customer service can vary, depending on the specific lender you are matched with.

- It’s crucial to carefully review all loan terms and conditions before agreeing to an offer.

How Do They Stack Up? Priority Plus Financial vs. the Competition

It’s essential to understand that Priority Plus Financial isn’t the only player in the online loan facilitation space. Several other platforms offer similar services. To give you a better perspective, let’s compare Priority Plus Financial to three direct competitors.

| Feature | Priority Plus Financial | National Debt Relief | Freedom Debt Relief | Accredited Debt Relief |

| Loan Types | Personal loans, debt consolidation, debt settlement, business loans | Debt settlement | Debt settlement | Debt settlement, debt consolidation loans |

| Network Size | Nationwide broker network | 41 states, 450,000+ clients served | 31 states, 850,000+ clients served | 30 states, 300,000+ clients served |

| Application Speed | Fast online application; pre-approval in minutes | Online/phone; free consultation | Online/phone; free consultation | Online/phone; free consultation |

| Potential APR Range | 5.49% – 29.99% (for loans) | N/A (fee-based, not loans; 15–25% of enrolled debt) | N/A (fee-based, not loans; 15–25% of enrolled debt) | N/A (fee-based, not loans; 15–25% of enrolled debt) |

| Minimum Credit Score | Not disclosed; generally flexible for debt relief | Not specified; accepts lower credit | Not specified; accepts lower credit | Not specified; accepts lower credit |

| Funding Speed | As fast as 24–48 hours for loans | N/A (settlement process takes months) | N/A (settlement process takes months) | N/A (settlement process takes months) |

| Customer Support Channels | Phone, email, online form | Phone, email; extended hours | Phone, email; extended hours | Phone, email, live chat (via Beyond Finance) |

Here’s some relevant points:

- Priority Plus Financial is unique among these companies for offering direct loans as well as debt relief, whereas the others focus on debt settlement (not lending).

- APRs are only relevant for actual loans; debt settlement companies charge fees based on a percentage of enrolled/settled debt, not interest rates.

- Funding speed for debt settlement companies refers to how quickly they can start negotiating, not to loan disbursement. Settlement programs typically take months to years to complete.

- Customer support for all companies includes phone and email, with Accredited Debt Relief also offering live chat.

This comparison highlights that while Priority Plus Financial offers a large network and relatively fast application speeds, other platforms might specialize in different loan types, offer potentially lower APRs for certain credit profiles, or provide even faster funding times. The key takeaway here is that comparing multiple options is crucial to finding the best fit for your unique circumstances. Don’t settle for the first offer you see!

Ready to Pull The Trigger? Here’s how to Apply

Have you made it this far and decided that you want to move forward with Priority Plus Financials service as a Loan matcher? We’re glad! You are probably now wondering how to apply. Here is a step-by-step breakdown of the application process:

- Visit the Website: Go to Priorityplusfinancial.com

- Fill Out Application Form: You’re gonna need personal info to fill this out, which includes your Social Security number. But using this info, Priority Plus Financial will be able to match you with lenders.

- Review and Submit: Review what you put down carefully. Submit when ready.

- Wait for Lender Matching: This is a short turnaround. Let their algorithm go to work finding you potential lenders.

- Review Loan Offers: Once the process is complete, you will be matched with lenders. This is an important step. Carefully review the following for all the results:

- Interest Rate (APR): Understand what borrowing will cost you. This is the extra cost on top of the loan you have to pay back.

- Loan Amount: Make sure they offer enough so you can do what you need

- Repayment Term: Understand the frequency and parameters for repayment. (Is it bi-weekly, etc)

- Fees: Be aware of the fees. Are there any prepayment penalty fees, etc.

- Accept an Offer: Once you find an offer that matches your needs and feels right, go ahead and select it. You will now be working directly with this lender, not Priority Plus Financial.

- Funding: Once you’ve completed this lender’s application process and gotten approved, your funds will be received shortly.

Important Note: Submitting an application does not guarantee loan approval. Each lender in the network will have its own eligibility criteria.

Is Priority Plus Financial the Right Choice for You?

Now, let’s circle back to the big question: Is Priority Plus Financial the right choice for your financial needs? Based on our exploration, here’s a summary of who might find their services beneficial and who might want to explore other options:

Priority Plus Financial Might Be a Good Fit If:

- You need funds relatively quickly. Their online platform and lender network can potentially expedite the loan process.

- You have a less-than-perfect credit history and have had difficulty qualifying for traditional bank loans. Their network of lenders may be more willing to work with a wider range of credit profiles.

- You want the convenience of comparing multiple loan offers in one place without having to apply to numerous lenders individually.

- You are comfortable with an online application process.

You Might Want to Consider Other Options If:

- You have a strong credit history and are likely to qualify for lower interest rates and fees from traditional banks or credit unions.

- You prefer a direct relationship with a financial institution and personalized service.

- You are uncomfortable with potentially higher interest rates that can sometimes be associated with online lending platforms.

- You have the time to research and apply to individual lenders to potentially secure more favorable terms.

Ultimately, the decision is yours. Carefully weigh your individual circumstances, compare the potential benefits and drawbacks, and thoroughly review any loan offers you receive.

Final Thoughts: Empowering Your Financial Journey

Navigating the world of personal finance can feel like a maze, especially when you’re facing immediate financial needs. Platforms like Priority Plus Financial offer a potential route to accessing funds, providing convenience and a broader network of lenders. However, it’s absolutely crucial to approach such options with a clear understanding of the potential costs and benefits.

Remember, thorough research is your most powerful tool. Don’t be afraid to explore multiple options, compare interest rates and fees, and carefully read the fine print of any loan agreement before committing. Understanding the terms and conditions is paramount to avoiding unexpected financial burdens down the line.

Whether Priority Plus Financial ends up being the right solution for you or not, the journey of understanding your financial options is a valuable one. By taking the time to learn and compare, you are empowering yourself to make informed decisions that align with your financial well-being and help you achieve your goals.

Frequently Asked Questions (FAQ) About Priority Plus Financial

Here are some common questions that individuals considering Priority Plus Financial might have:

Q: Is Priority Plus Financial a direct lender? A: No, Priority Plus Financial is not a direct lender. They operate as an online platform that connects borrowers with a network of third-party lenders.

Q: Will applying for a loan through Priority Plus Financial affect my credit score? A: Typically, the initial application process involves a “soft credit inquiry,” which should not negatively impact your credit score. However, if you proceed with a loan offer from a specific lender, they may perform a “hard credit inquiry,” which can have a small, temporary effect on your score.

Q: What are the typical interest rates for loans obtained through Priority Plus Financial? A: Interest rates can vary significantly depending on factors such as your credit score, the loan amount, the repayment term, and the specific lender you are matched with. It’s essential to carefully review the APR (Annual Percentage Rate) of each loan offer you receive.

Q: How quickly can I receive funds after being approved for a loan through Priority Plus Financial? A: Funding times can vary by lender, but many loans facilitated through online platforms aim for relatively quick funding, often within 1-3 business days after approval and acceptance of the loan agreement.

Q: What types of loans can I potentially access through Priority Plus Financial? A: Their primary focus is typically on personal loans, which can be used for a variety of purposes. However, the specific types of loans available may depend on the lenders within their network.